Calculate my net pay after taxes

How to use the Take-Home Calculator. Your package Fixed Pay X of total package Variable Pay 100-X of total package.

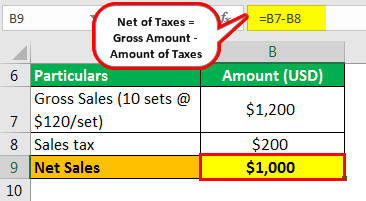

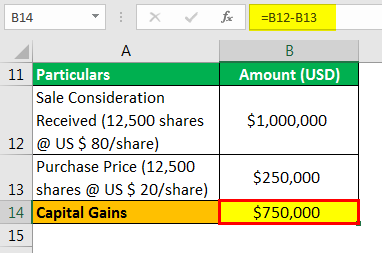

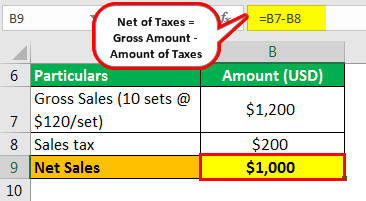

Net Of Taxes Meaning Formula Calculation With Example

Calculate your take home pay after various taxes.

. This places Ireland on the 8th place in the International. To calculate net pay deduct FICA tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

After deducting taxes the average single worker in Sydney takes home 53811 yearly or 4484 per month. How to Negotiate Salary. If you are earning a bonus payment one.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. It can also be used to help fill steps 3 and 4 of a W-4 form. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Ad Find Out If Your Net Worth Is Positive Or Negative With AARPs Free Online Calculator. Get Your Quote Today with SurePayroll.

Where you live - The. How to calculate the net salary. Your employer withholds a 62 Social Security tax.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Rates remain high in Melbourne where median weekly earnings top 1200. Read reviews on the premier Paycheck Tools in the industry.

Calculate your take home. Payroll So Easy You Can Set It Up Run It Yourself. Federal state and local income taxes.

You can change the calculation by saving a new Main income. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. The PAYE Calculator will auto calculate your saved Main gross salary.

Ad Compare This Years Top 5 Free Payroll Software. That means that your net pay will be 37957 per year or 3163 per month. Your average tax rate.

This would give you a monthly net pay of 1383. For US AU residents. This places US on the 4th place out of 72 countries in the.

Calculate the net after-tax or inversely the gross pre-tax salary in Greece after insurance. Your gross salary - Its the salary you have before tax. Constantly updated to keep up with the latest budget released.

And health insurance from the employees gross pay. Subtract deductions to find net pay. Ad Get Started Today with 1 Month Free.

Free Unbiased Reviews Top Picks. All Services Backed by Tax Guarantee. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

To calculate your net pay subtract 700 your deductions from your gross pay of 2083. That means that your net pay will be 43041 per year or 3587 per month. Adjusted gross income - Post-tax deductions Exemptions Taxable income.

Sign Up Today And Join The Team. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

A Calculator To Help You Determine Your Net Worth Estimate How It Could Grow Or Shrink. Learn About Payroll Tax Systems. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. How do you calculate variable pay. Taxable income Tax rate based on filing status Tax liability.

To stop the auto-calculation you will need to delete. Ad See the Paycheck Tools your competitors are already using - Start Now. Federal Salary Paycheck Calculator.

Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. The calculator will work out how much tax youll owe based on your salary. Ad See the Paycheck Tools your competitors are already using - Start Now.

So variable pay is part of your salary. Read reviews on the premier Paycheck Tools in the industry. How Your Texas Paycheck Works.

In order to calculate the salary after tax we need to know a few things.

How To Calculate Net Pay Step By Step Example

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Percent Project Personal Finance Calculate Tax Rates Create Paychecks More Math Enrichment Upper Elementary Math Math Enrichment Projects

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Self Employed Tax Calculator Business Tax Self Employment Employment

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Accounting And Finance

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Tax

Net Of Taxes Meaning Formula Calculation With Example

Teks 5 10b Taxes Personal Financial Literacy With Project Personal Financial Literacy Financial Literacy Literacy

Uwbwzrdeeffokm

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Gross To Net Calculator

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Net Of Taxes Meaning Formula Calculation With Example

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Profit After Tax Definition Formula How To Calculate Net Profit After Tax